Photronics Stock Summary

Photronics is a supplier to the semiconductor industry with P/FCF below 10x

Photronics is a semiconductor stock that I came across when looking for low free cash flow multiple stocks. I work in the semiconductor industry, but usually don’t pay attention to the stocks since they seem to always trade at a premium. However, I thought it would be fun to look at Photronics. The stock is down nearly 50% from its peak in early 2024, and is down 24% year to date. Currently the market capitalization is at $1.14B, which is considered small cap.

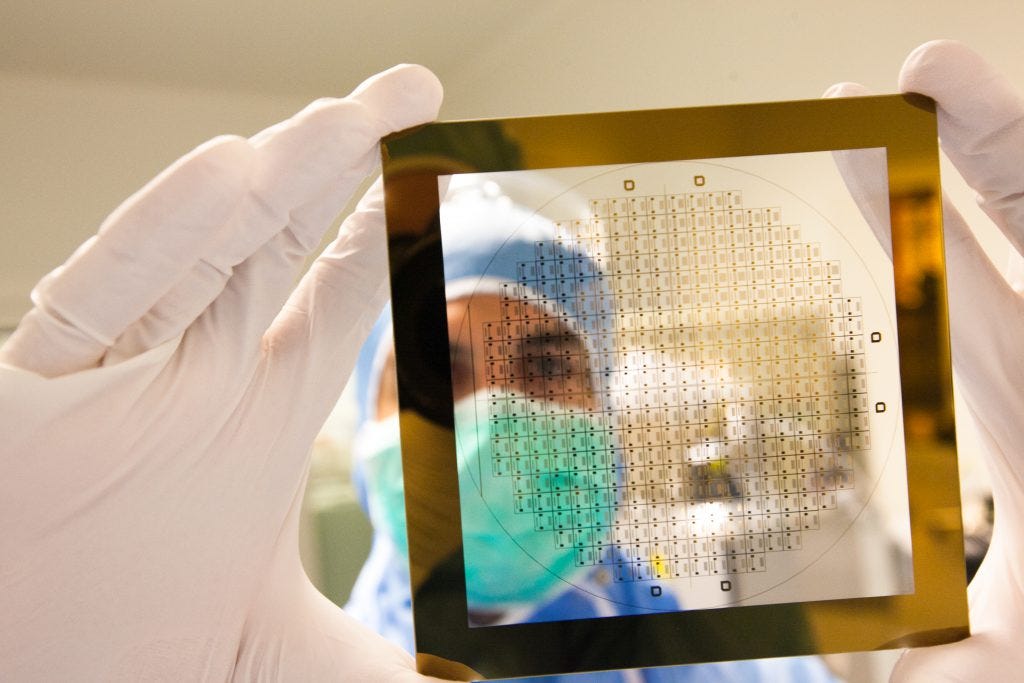

Photronics manufactures photolithography masks, which is a key component to the manufacture of integrated circuits. There are a few companies that produces lithography masks, but Photronics is a leading company in this industry. PLAB’s main sources of revenue is the production of masks for integrated circuits and flat panel displays. In both cases, there are masks for advanced, modern designs and masks for low end or antiquated designs. Photronics is trying to lean into the higher end masks since these have better profit margins. The company has 11 manufacturing facilities fairly spread out between Taiwan, China, Korea, US and Europe. About 85% of PLAB’s sales come from outside the US, with China having 25% of sales and Taiwan coming in at 33%.

I think there are a couple of reasons why Photronics is out of favor. The first reason is the modestly high amount of sales from China with concerns over trade and semiconductor technology sales to China. Related to that is the fact that demand for photolithography masks are dependent on new electronic device release, not the demand for chips themselves. This is because a device maker only needs a new mask when they make a new chip design. With the trade uncertainties, device manufactures are cutting back on rolling out new products. On the flip side, as chip makers start adding AI capabilities into their devices, this should eventually create demand for many new chip designs which will be beneficial to Photronics. Additionally, demand for chips used in automotive or industrial that utilize older transistor technologies have been weak for the past year, which has weighed down revenue. Photolithography mask making requires a lot of fixed assets, so if sales decline margins take a heavy hit. This weak demand should be temporary, so Photronics will eventually recover sales and margins in the next year or so.

Turning to Photronics balance sheet, the company has $558M in cash, which is around half their market capitalization. A few years ago, PLAB had a little bit of debt, but has paid it off. The strong balance sheet is definitely a plus for me. Sales have nearly doubled in the last 10 years, but have come down a bit since the peak in 2023. Gross and operating margins have bounced around, but PLAB has generated $216M in operating income in the last twelve months. Average return on assets over the last five years has been 6.6%, which isn’t too impressive but is also weighed down by the heavy cash position. Average operating cash flow for the last three years is $279M, and average capex was $125M. This puts Photronics average free cash flow at $154M, which based on their current market cap produces a FCF multiple of 7.4x. A free cash flow multiple below 10 gets my attention, so PLAB is another stock to add to my todo list. As for shareholder returns, Photronics does not have a dividend, but they have done some share buybacks. In the latest twelve months, PLAB has spent $77M on buybacks, which is good to see that they are taking advantage of their beaten up stock price.

Overall, Photronics seems like an interesting company in an industry that I do not spend much time looking at. I will have to do more due diligence to get a more accurate fair value estimate, but they stock certainly seems cheap with its low free cash flow multiple. Semiconductor stocks are known to be cyclical and it seems like PLAB has been in a down cycle for a while, plus uncertainties with the trade war. These seem like temporary issues that will eventually be resolved, which is the kind of setup I like when looking for value stocks.

Stocks mentioned: PLAB 0.00%↑

Saw this also but it has historically traded around this multiple & i don't know enough about the industry. Seems hard for a re-rating unless they just turn the buyback machine on.