Performance Overview

For Q3 2023, my stock picking portfolio was up 4.4%, and up 13.1% YTD. The Q3 starting balance was $90,365.16, and finished the quarter at $95,652.79. Contributions to the portfolio during the quarter amounted to $1,291.

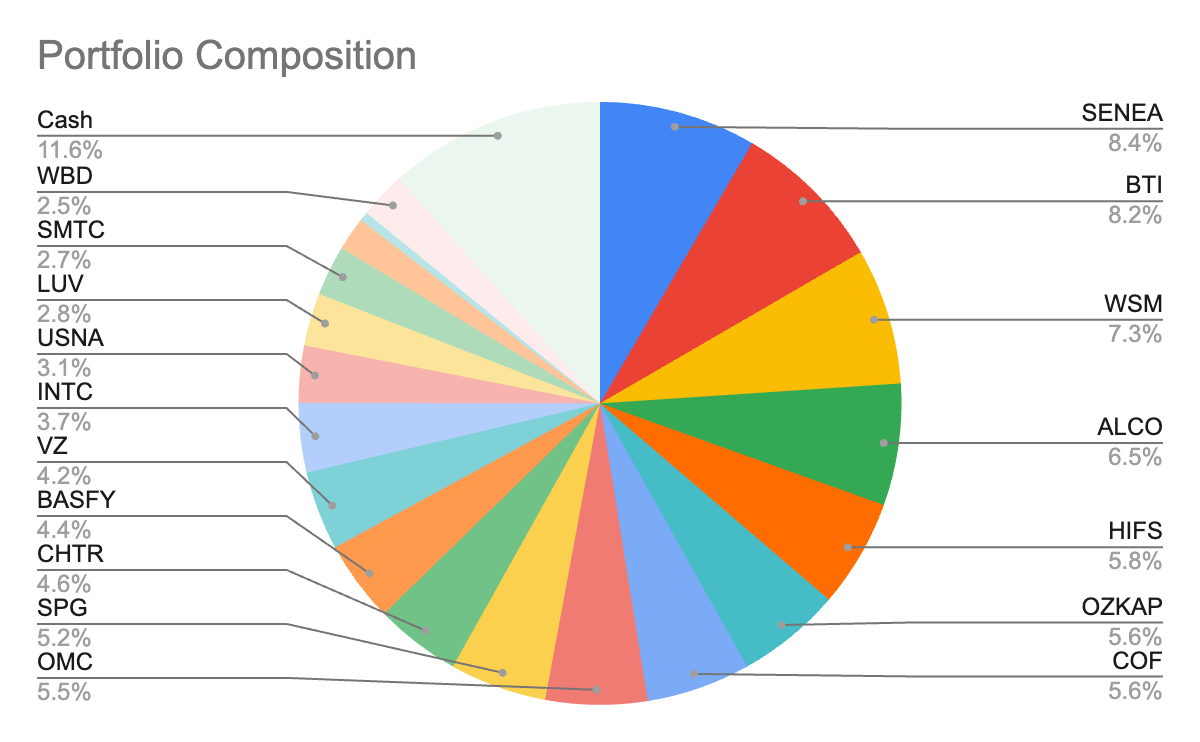

Portfolio Composition

The current allocation of the portfolio is shown in the chart below. Currently, the portfolio consists of 19 stocks. The top five largest positions are Seneca Foods, British American Tobacco, Williams-Sonoma, Alico, and Hingham’s Institute for Savings.

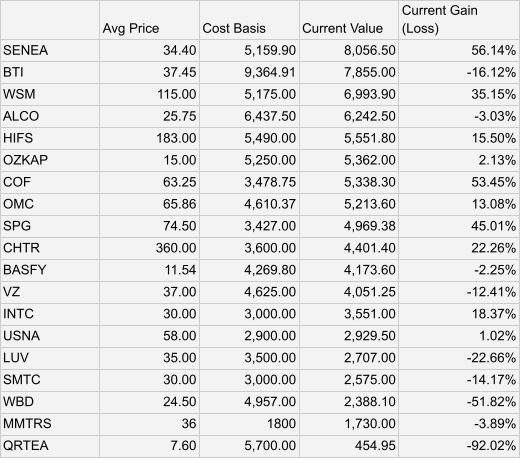

Current Holdings

My portfolio generally consists of two types of stocks. The first is quality companies that I believe are facing a negative setback in which the market has over-reacted to. I will typically perform more due diligence on these companies, and size the position around 10% of the portfolio at purchase.

The other stocks I hold could be trading at a low valuation multiple, be a net-net, special situation, etc. I usually do less due diligence on these companies, and hold them for shorter periods of time. Accordingly, I take a basket approach where each individual stock makes up 2-5% of the portfolio.