Performance Overview

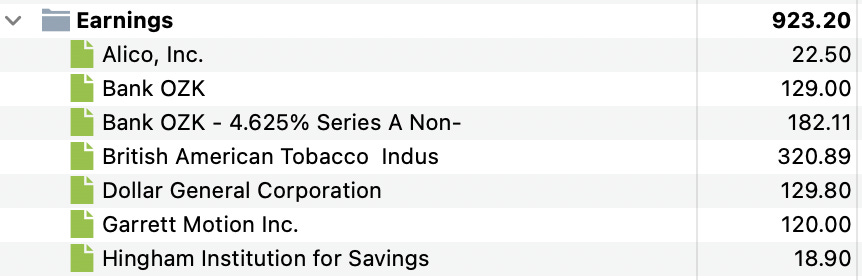

For Q2 2025, my stock picking portfolio was up 11.1%, and is up 12.9% YTD. The Q2 starting balance was $166,720.93, and finished the quarter at $207,390.66. Contributions to the portfolio during the quarter amounted to $19,306.88.

Portfolio Composition

The current allocation of the portfolio is shown in the chart below. Currently, the portfolio consists of 16 stocks. The top five largest positions are Dollar General, Garrett Motion, British American Tobacco, Tandy Leather, and Net Lease Office Properties.

Current Holdings

My portfolio generally consists of two types of stocks. The first is quality companies that I believe are facing a negative setback in which the market has over-reacted to. I will typically perform more due diligence on these companies, and size the position around 10% of the portfolio at purchase.

The other stocks I hold could be trading at a low valuation multiple, be a net-net, special situation, etc. I usually do less due diligence on these companies, and hold them for shorter periods of time. Accordingly, I take a basket approach where each individual stock makes up 2-5% of the portfolio.

Stocks Purchased and Sold

Two new stocks were purchased late in the quarter: Swatch Group and Photronics. Earlier in the quarter I added to my position in Net Lease Office Properties, Garrett Motion, and Bank OZK.

I sold three stocks that were each merger arbitrage deals: Bank of Idaho, Beacon Roofing, and Old Point Financial. My portfolio tracking software does not handle short sales, so not shown is the short position in Glacier Bancorp since they were buying Bank of Idaho in an all stock deal. I bought back the short position when I sold Bank of Idaho. The realized gains were 8.1% for Old Point Financial, 5.1% for Beacon Roofing, and a 6.1% gain for the long Bank of Idaho and short Glacier Bancorp combo.

Congrats on breaking $200K!