Performance Overview

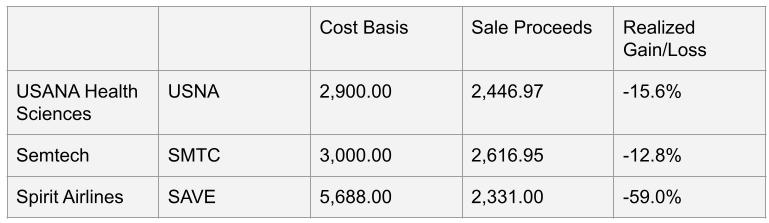

For Q1 2024, my stock picking portfolio was up 0.5%. The Q3 starting balance was $84,621.38, and finished the quarter at $87,934.88. Contributions to the portfolio during the quarter amounted to $2,823.

Portfolio Composition

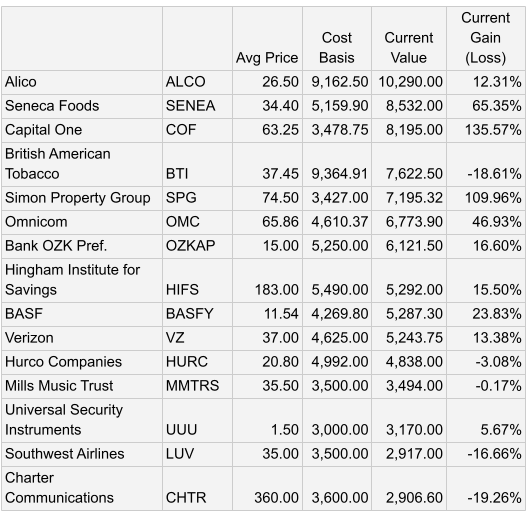

The current allocation of the portfolio is shown in the chart below. Currently, the portfolio consists of 17 stocks. The top five largest positions are Alico ALCO 0.00%↑ , Seneca Foods SENEA 0.00%↑ , Capital One COF 0.00%↑ , British American Tobacco BTI 0.00%↑ , and Simon Property Group SPG 0.00%↑ .

Current Holdings

My portfolio generally consists of two types of stocks. The first is quality companies that I believe are facing a negative setback in which the market has over-reacted to. I will typically perform more due diligence on these companies, and size the position around 10% of the portfolio at purchase.

The other stocks I hold could be trading at a low valuation multiple, be a net-net, special situation, etc. I usually do less due diligence on these companies, and hold them for shorter periods of time. Accordingly, I take a basket approach where each individual stock makes up 2-5% of the portfolio.