Best of 2023 Berkshire Hathaway Annual Shareholders Meeting

It has been a few days since the 2023 Berkshire Hathaway annual shareholder meeting, but I am just now getting settled in at home and work from my travels to Omaha. I had a great time hanging out with my friends from the Dayton Value Investors group (who mostly aren’t from Dayton), and chatting with other value investing nerds.

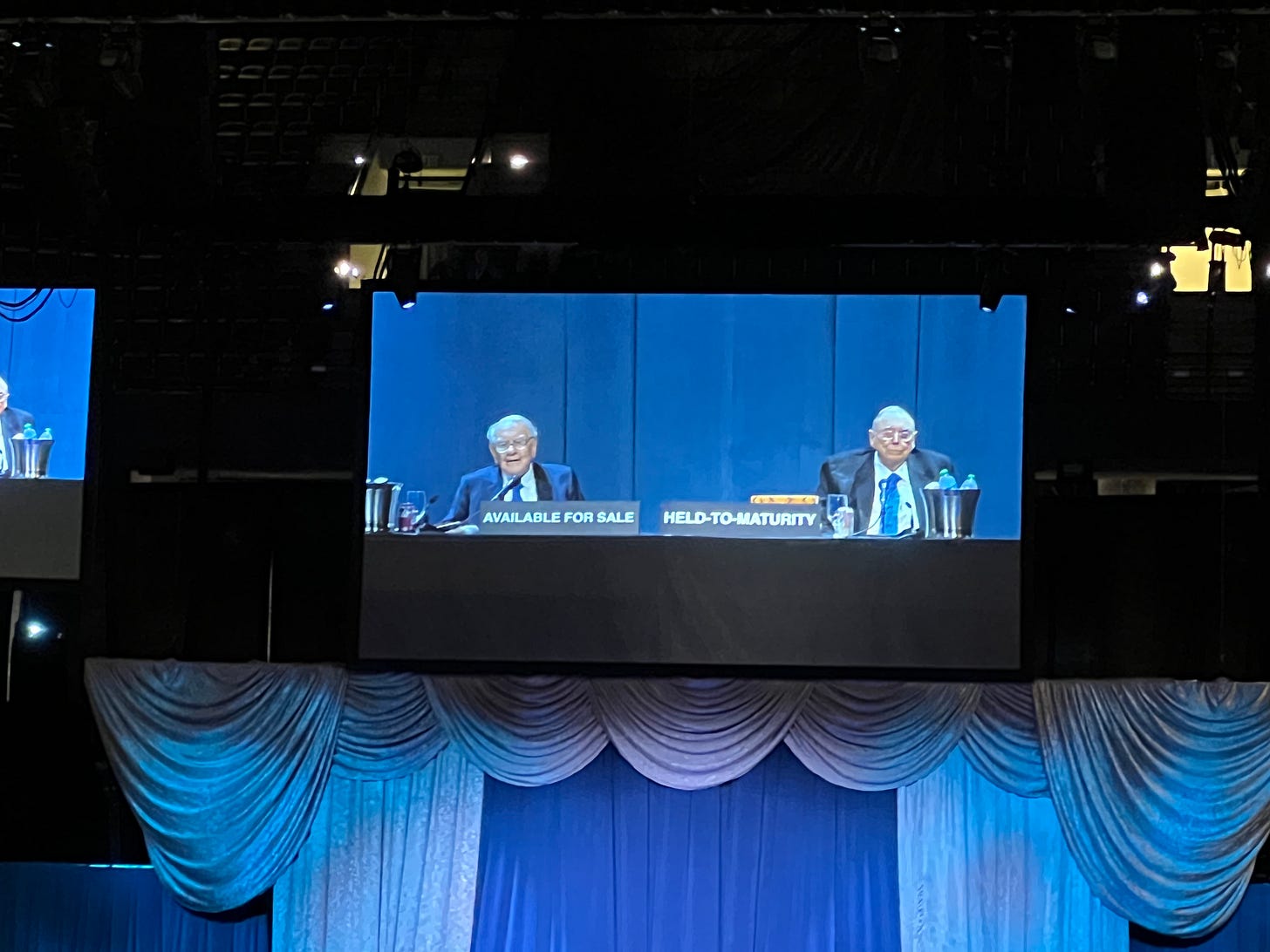

Of course, the primary event of the weekend is listening to Warren Buffett and Charlie Munger answer questions for 6 hours (Greg Abel Ajit Jain were present in the morning session), providing us some wisdom and humor. It is amazing that Warren at 92, and Charlie at 99 are sharp as razors and can rattle off more facts and figures than most people half their age. With that, let’s get into the best parts of the Q&A session.

You can watch the full replay of the Q&A session on CNBCs website. Also, one of my favorite Twitter/Substack follows, The Rational Walk summarized each question asked during the meeting.

At the beginning of the meeting, Buffett briefly talked about Q1 operating results. An interesting statement that came out of this was that Berkshire has a book value of $505B, which is more than any other US company. There are other company’s that have a higher market capitalization due to their stock price getting bid up, but nobody has as high of a net worth as Berkshire.

One question I thought was interesting was about estate planning. Buffett mentioned that any time he changes his will, he makes sure all his kids see it first. He adds that if the kids see your will for the first time once you’re dead, there is certainly going to be drama. In response to a related question, Warren mentions that if you want your kids to have good values, then you need to model them instead of just talk about them (some people don’t even do that).

There was a brief discussion on BNSF and train derailments. In last months CNBC interview, Buffett said that Norfolk Southern has not properly handled the recent derailment in Ohio. Warren mentioned that BSNF is a common carrier, meaning they have to carry hazardous materials even though he would rather not. Also, it was mentioned that there are about 1,000 derailments a year. Apparently there was a recent BNSF derailment on Native American territory that has caused some drama. Greg Abel indicated that they made mistakes and were hoping to fairly rectify the situation.

Someone asked a question about risks to America being a superpower. Warren replied with America being a miracle, having 0.5% of the world’s population in 1776, and now has 20% of the world’s GDP. He thinks even though there are issues, the country is better now than it was when he was young. The issues are just now more amplified due to the ease of communications. Buffett is concerned that partisanship has morphed into tribalism, where each side won’t even listen to each other. Charlie was a bit more cynical, saying that the key to happiness is having low expectations.

One question referenced Aswath Damadoran, a professor at New York University who has great lectures and book on valuation, who contends that Berkshire’s Apple position is too concentrated. Munger thought that Damadoran was out of his mind. Buffett explained that he considers the Apple stock position the same as wholly owning BNSF. Even though Apple is 35% of the stock portfolio, it is much less if you consider all the wholly owned Berkshire businesses.

In the afternoon, someone finally asked about the recent banking crisis. Buffett mostly reiterated what he said in the CNBC interview last month. He believes it is in the country’s interest to guarantee all deposits because not doing so would wreck the global financial system. He compares it to the reoccurring debt ceiling debacles where it would be stupid to let the Government default on their debt, blowing up the world’s financial system.

Additionally he commented that the public is being irrationally fearful of banks when FDIC addressed most of their problems. He followed this by stating that the politicians either don’t understand the banking system, or purposefully act like they don’t understand to create unnecessary political drama. Buffett did say that the owners of the bank stocks and bonds should not be immune to their investments going to zero. He also stated that banking executives should have skin in the game and be outcasts from society if they preside over a bank failure.

A related question was on regional banks. Buffett didn’t go into specifics on whether regional banks were safe, but said that any bank that does reasonable lending with low expenses can be a good business. He then went into a mini history lesson on how Berkshire fully owned a bank in the late 1960’s, but had to dispose of it because of the Bank Holding Act of 1970.

These were some of the topics I thought were interesting from shareholders meeting, but there were plenty of other areas covered. In some years the questions can be a bit iffy, but this year I would recommend listening to the rest of the meeting.