2025 Portfolio Update

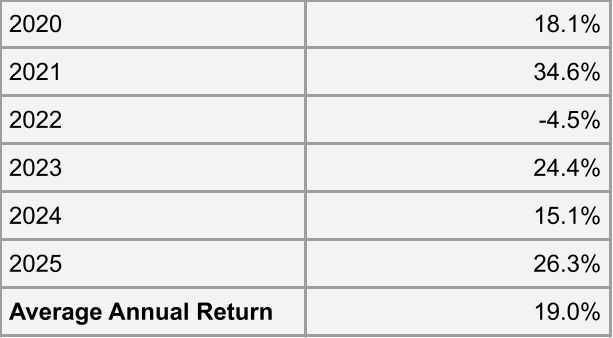

My portfolio was up 26.3% in 2025, and my 6 year CAGR is 19.0%

Performance Overview

For Q4 2025, my stock picking portfolio was up 4.9%, and is up 26.3% for the full year. The starting balance at the beginning of the year was $130,512.23, and finished the year at $266,762.71. Contribution for the full year amounted to $87,196.26. The table below shows my portfolio returns since I have been publicly posting my performance.

Year in Review

In preparing for this years review, I took a look at what I wrote last year and noticed in many ways 2025 was a repeat of 2024. Some of the repeated themes were the continuation of AI hype, the big technology companies continuing to drive S&P 500 returns with increasing index concentration, moderation of inflation, the Federal Reserve cutting interest rates, and small stocks underperforming large market capitalization stocks. Bear in mind that these themes did not change how I invested during the year. I just think it is interesting to look back on some interesting market data points and compare how my portfolio fared through these events.

One of the major stories of 2025 was the hard and heavy rollout of tariffs. Liberation Day occurred on April 2nd, and the market was not expecting such broad tariffs against so many countries at once. Two days after announcement market lost $5 trillion in value. Overall the S&P 500 was down nearly 19% peak to trough, while the Russell 2000 was down around 24%. Stocks started to rebound a few weeks later, after the administration declared a 90 day pause on tariffs. By mid May the index regained most of its losses and charged ahead the rest of the year.

During the selloff I was lightening up the wallet, adding to my Bank OZK, Net Lease Office Properties, and Garrett Motion holdings. I remember frantically watching stocks nosedive while my family was visiting the Pittsburgh Children’s Museum on our mini vacation. What a convenient time for a selloff! Even though things looked scary I tried to look past the noise and assumed the tariffs would fizzle out, or corporations would readjust their supply chains and pass costs onto consumers.

Most of the companies in my portfolio were not directly impacted by the tariffs, with the exception of Jewett-Cameron. Over the past couple of years the company has diversifying its supply chain from china to utilize Vietnam, which backfired when Vietnam also had stiff tariffs. JCTC sells fencing products to big box home improvement stores, and it turns out they have very little pricing power. The retailers did not want to raise prices, which put a heavy squeeze on gross margins. Tariffs may be another big story in 2026, but with most macro economic things, its hard to predict how impactful it will be to stock prices.

Like 2024, the big narrative in the market was AI stocks, Nvidia, and the Magnificent 7. The individual Magnificent 7 gains were: Nvidia 35%, Google 64%, Microsoft 14%, Tesla 13%, Apple 12%, Meta 10%, Amazon 3%. I was a bit surprised that besides Google and Nvidia, the rest of these tech stocks had pretty mild gains. If you took away Google and Nvidia, S&P would only be up 7%. Overall this collection of stocks represented 37% of the S&P 500 market capitalization, and contributed to about half of the gains for the index. The concentration of the Magnificent 7 in the S&P 500 is three times higher than back in 2015.

During the year Nvidia surpassed $4 trillion market capitalization, then the $5 trillion milestone. Nvidia was “only” up 35% in 2025 compared to a whopping 170% in 2024. The peak of the AI frenzy was probably in September when Oracle announced a $300B AI infrastructure deal with OpenAI. The stock went up 40% in a single day to all time highs. Later in November the market soured on Oracle after realizing this investment amounts to a large addition of debt, and the revenue from this build out could take a while to materialize. Now the stock is down about 40% from its highs, including a 14% drop in December. It seems like everyone is cautious that the AI bubble will pop, which makes me think there is plenty of road ahead for euphoria.

I do not want to sound too bearish since the big technology stocks are great companies and AI will obviously be impactful at some point. Honestly, I really did not think much about these tech stocks throughout the year. Instead, I just kept fishing in the familiar pond of small, out of favor companies. My main point is that buying undervalued stocks can still modestly outperform the S&P 500 and all its hoopla. Now the challenge is to keep trying to beat the S&P 500 juggernaut, and hope if the AI bubble does burst, my stocks are not caught in the wake.

Since I am a value investor who usually buys small companies, I like to compare the Russell 2000 value index to the S&P 500. For 2025 the Russell 2000 value was up about 12%, underperforming the S&P 500’s 17% return. These figures do not look too bad until you consider that the S&P 500 is up 112% over the last five years and the Russell is only up 48%. That translates into a 16.2% CAGR for the S&P 500 vs an 8.1% for the Russell value index. The underperformance of small cap value to larger stocks has persisted for over 12 years. This is highly unusual, because historically small cap value is one of the best performing grouping of stocks.

Some of the reasons for this underperformance could be explained by technology stocks making up one third S&P 500 market cap, where the Russell value index only has a 5% weighting towards technology. The Russell 2000 value index is concentrated in regional banks and real estate which have had a rough time the past couple of years. Plus small caps are generally slower growing businesses than their larger brethren. Perhaps the companies in the Russell 2000 are of lower quality than the stocks that end up in my portfolio. My hope is that small cap returns mean revert back to their past record of outperforming the S&P 500, then this should be a nice tailwind to my portfolio in the future.

Another theme throughout 2025 was the decline in consumer sentiment. This had an impact on some of the companies in my portfolio, but also created opportunities that led to some new holdings. The University of Michigan consumer sentiment survey shows results near 2008 recession lows. Consumer sentiment plunged after tariff announcements, did not recover despite Fed rate cuts. This low sentiment reading is unusual because we still had 4% GDP growth and pretty low unemployment. Now one could argue that surveys are not always provide the best gauge of reality. However I think the suggestion that middle and lower income consumers are being squeezed has been observed in the market narratives and financial results of some of the stocks that I have been interested in.

For example, last year the narrative was that Dollar General was performing poorly due to their core customer comprising of low and/or fixed income demographic that was spending less on discretionary items due to inflation. Then after the tariff announcements, everyone was worried about a recession. The narrative shifted to Dollar General being a good stock to own since middle class consumers would trade down to save some money.

More generally speaking, I think a weak consumer has impacted the sale of leather crafting goods at Tandy Leather, and lower spending on home renovations has reduced the sales of Jewett-Cameron’s fencing products. Cautious consumers also seem to have impacted media companies such as Saga Communications and Ziff Davis.

Related to the weak consumer confidence is the weak industrial confidence. The US manufacturing PMI has spent most of the year below 50, which indicates a contraction in purchasing. This data point has been weak for a couple of years, impacting Hurco who manufactures CNC machines. If businesses are hesitant to spend capex on manufacturing, then they will need less machines from Hurco. It is hard to tell at this point what would make consumers feel more optimistic in 2026, but eventually things will work out. In the mean time I will continue to scoop up these out of favor stocks.

Portfolio Composition

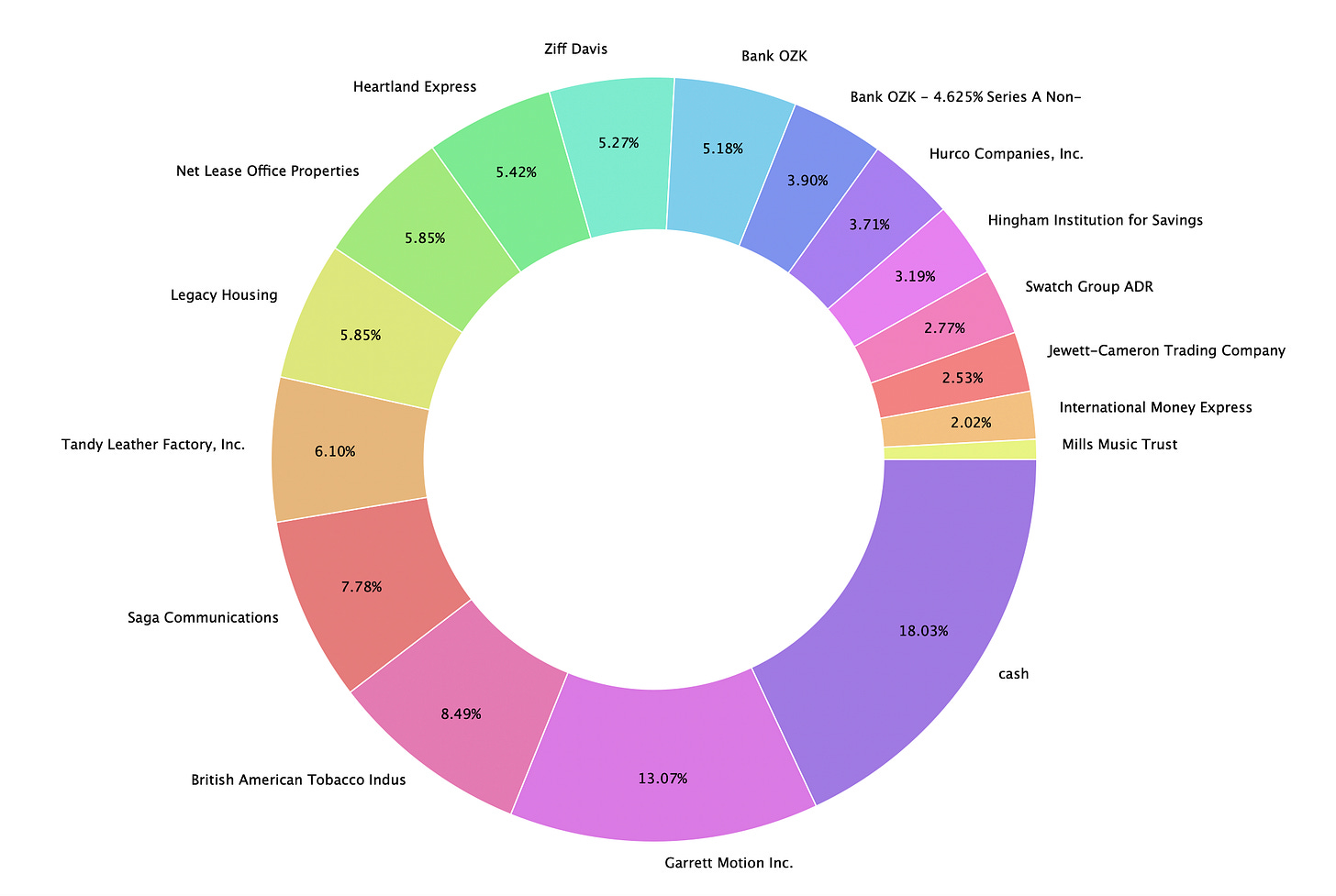

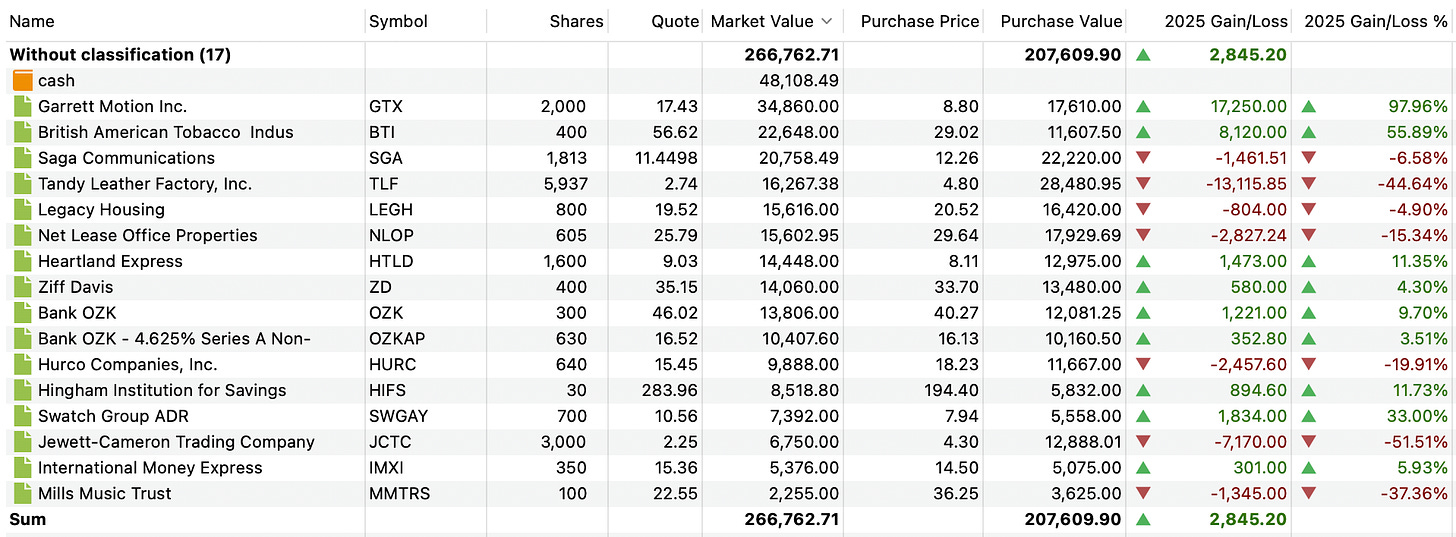

The current allocation of the portfolio is shown in the chart below. Currently, the portfolio consists of 16 stocks. The top five largest positions are Garrett Motion, British American Tobacco, Saga Communications, Tandy Leather Factory, and Legacy Housing.

Portfolio Update

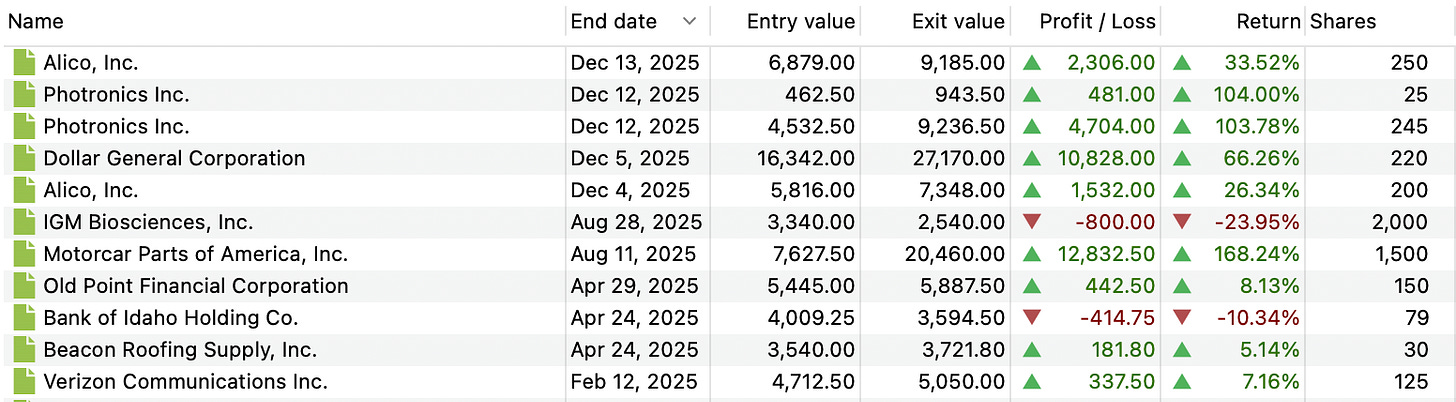

This year there were several stocks that meaningfully contributed to the portfolios return. Current holdings include Garrett Motion that was up nearly 100%, and British American Tobacco that was up 55%. Out of the stocks that I sold, Motorcar Parts of America, and Dollar General provided sizable dollar and percentage gains. Photronics was up over 100%, but did not contribute as much since it was a smaller position. The main loser of a stock this year was Jewett-Cameron, which is facing declining sales and margins. Tandy Leather appears to have a large losses this year, however the company paid out large special dividend so the loss is not as bad as it looks.

The following are brief descriptions of my top five holdings and why I think they were undervalued when I purchased them.

Garrett Motion

Garrett Motion is an auto parts supplier that I bought it earlier this year. Garrett’s main product is the design and manufacture of turbochargers. Turbochargers are components that force more air into an engine, which can either increase power, or allow smaller more fuel efficient engines with comparable power to non-turbocharged version. The market acted like turbochargers for combustion engines are obsolete with adoption of EVs. The stock was also punished because weird balance sheet resulting from a spinoff and bankruptcy, plus GTX has seen declining revenue due to a drop in car sales the past year. I bought the stock because thought the car industry would bounce back in a year or so, and the company is still producing lots of cashflow in this tough environment. Also I think it will take longer for EVs to take over than what the consensus believed. A few months ago GTX initiated a dividend and buybacks. The stock price has gone up nicely since I bought it, but it is still not quite at my fair value.

British American Tobacco

I first bought shares of British American Tobacco in 2021 and added more in 2023 and 2024. The reason why the company was out of favor when I bought it was due to ESG pressures, declining cigarette volumes, and a heavy debt load from its 2018 acquisition of RJ Reynolds. Additionally BTIs newer tobacco products remained a small, unprofitable share of sales. My thesis was that cigarette volume declines would eventually stabilize, strong pricing power during inflation would protect margins, the new tobacco products could be a cherry on top, while the high dividend yield would be attractive. British American Tobacco’s cigarette volume declines proved steeper than I expected, however BTI offset much of the impact through price increases. The stock continued paying its dividend, reduced debt, and even initiated some share buybacks. BTI has since rallied sharply this year and is now trading above my estimate of fair value.

Saga Communications

Saga Communications is a microcap stock that I have been building a position during the second half of the year. The company owns 82 FM radio stations, 32 AM stations. Obviously radio is in a secular decline, but there are still a decent amount of listeners. Most of Saga’s sales comes from advertising for local businesses. Over the past couple of years main street has been struggling, so ad spend has been weak. However, Saga trying to expand their digital offerings to counteract the decline in traditional radio.

The reason I like the stock is because it is trading below 0.5x book value. The market thinks radio stations are obsolete, but I the industry is in a cyclical decline on top of a slower secular decline. With a slow secular decline, Saga can sell off underperforming assets, buyback shares, and continue to invest into digital marketing. On the cyclical side, hopefully in 2026 Main Street bounces back, boosting Saga’s revenue. Another thing that I like about Saga is that unlike most radio and TV broadcasters, Saga has no debt and a nice cash balance. The company recently sold some radio towers, with the proceeds being planned to be used for buybacks. Another aspect to Saga is that I think the Trump administration would be open to consolidation in the radio and TV broadcasters, which historically has been thorny. Therefore I would not be shocked if Saga got acquired in the next couple of years.

Tandy Leather Factory

Tandy Leather Factory is a microcap stock that is a retailer for leather crafting goods. Sales have been disappointing the past couple of years, which is a trend I’ve noticed with some other retailers. Early this year, Tandy sold their Dallas area headquarters/warehouse for a price much higher than the value stated on their books. After the sale, TLF paid a large special dividend. The stock was a net-net when I started buying before the sale of the property, and is still a net-net after the sale and special dividend. I think once sales recover a bit, the stock will move closer to its net current asset value.

Legacy Housing

Legacy Housing is another recent addition to the portfolio. The stock is a microcap with a market cap around $500M and they primarily manufactures mobile homes. Legacy also provides consumer lending for homes, park owner financing of homes, and financing to investors buying parks. Sales for the company peaked in 2022 coinciding with stimulus checks. Since then, higher interest rates and pressured consumers have put a damper on sales. Luckily sales to park owners have maintained pretty consistent, so the the diversification helps. The company should continue to do well since they provide the most affordable form of housing, even if many people scoff at the idea of mobile homes. Legacy has no debt, trades for about book value and 10x earnings. If rates continue to fall and consumer sentiment improves, the company should revert back to their historic sales growth trend and produce higher profits.

Stocks Purchased

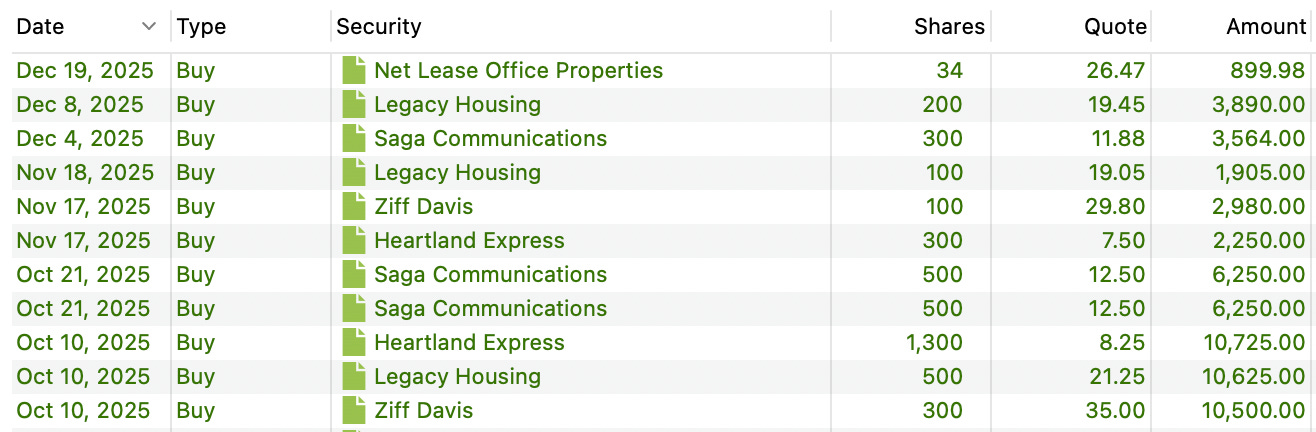

During the fourth quarter I bought four stocks: Ziff Davis, Legacy Housing, Heartland Express, and Saga Communications. I already discussed Legacy Housing and Saga Communications, so I will briefly discuss Ziff Davis and Heartland Express. Ziff Davis owns several online media properties such as CNET, PC Mag, Lifehacker, IGN, Ookla Speedtest. The stock is out of favor primarily due to AI fears and a sluggish advertising market. The worry is that instead of Googling a topic, and clicking on one of Ziff Davis’ websites, the Google’s AI summary will address the searchers needs. However the company’s management has pointed out that relatively small portion of their traffic comes from search, so these fears could be overblown. Also I personally think websites with niche content would have tendency to have repeat visitors opposed to just randomly landing on one of Ziff Davis’ webpages. As far as the sluggish ad market, I think its a similar story to Saga Communications where consumers are weak in certain spending categories. This seems like a cyclical story which is something that will eventually work itself out. Right now ZD is trading around 7x free cash flow and if the ad market improves, I think the company could be worth closer to $50 a share.

The final stock that I bought this quarter was Heartland Express. Heartland is a truckload carrier (opposed to a less-than truckload carrier) that was historically known for their efficiency. However they made some ill-timed acquisitions right before large freight rate recession that has plagued the industry for over three years.Low freight rates, less shipping due to large inventory build ups during COVID, and increased expenses due to inflation have caused Heartland to post a rare loss in 2025. Despite their missteps, Heartland has been trying to right the ship. The company has been focused on paying down debt the last few years, achieving a modest debt-to-equity ratio. The low leverage provides me with more confidence that they will weather the trucking storm. Based on my estimate of how much the business can earn in a more normal environment, I think Heartland could be worth near $18 a share.

Stocks Sold

In the fourth quarter I sold Dollar General, Alico, and Photronics. I bought Dollar General late 2024, and acquired some more shares early in 2025. My average purchase price was around $75. At the time the stock was being punished due to low income consumers being impacted by inflation. Also the former CEO who led DG during their high growth phase replaced the previous management who seemed to have mismanaged the company operationally. During 2025 DG same store sales and margins started to improve. This was especially evident after Dollar General reported a solid fiscal Q2, which saw the stock ran up to my estimated fair value of $124. With the stock providing a nice 66% gain in less than a year, and it reaching my fair value, I decided to sell my position.

Alico is a stock I’ve owned for a few years that I decided to sell after an unexpected run up in price. The company was the largest orange grower in Florida, but hurricane damage and fruit disease caused the company to abandon growing citrus and focus on developing and selling their land. Originally I thought Alico stock would bounce back once they had a couple of good harvests, while at the same time I thought the stock was trading far below a reasonable value of their land. With the new focus on land development, the value of their land will eventually get realized. However their main development project outside of Ft. Meyers is expected to take 5 years. I have already been patient with this stock, so I decided to cut it loose after achieving a decent gain

Photronics is a stock that I bought in the summer of 2025 at an average cost of $18.50. They manufacture photolithography masks, which is a critical component to integrated circuit manufacturing. Photomask sales have been down due to a slow down in television sales, and not as many new chips being released. The company seemed to be trading at a cyclical low earnings multiple, and after announcing earnings in December the stock shot up to $36. My fair value was around $29 a share and my only regret is not building a bigger position.

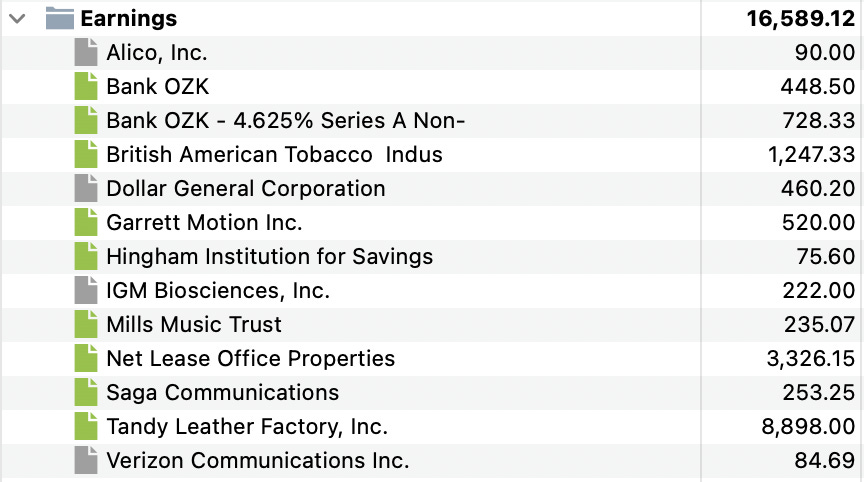

Dividends

Note that Net Lease Office Properties and Tandy Leather had large special dividends.

Microcaps in your top 5 holdings...

Some undervalued stocks in industries going through secular declines...

Cash at 18%...

That's a five star portfolio right there! It's nice seeing the thought process behind your moves.

Your portfolio and investment process are truly yours.

One more thing. I really like the fact that you have decent cash balance. It shows that you don't want to sell your best ideas to raise capital to buy new stocks. Is it a drag on your returns? Yes

Will it allow you to compound and produce excellent long-term results? Yes

I also sold out of Alico recently. Better fish out there.

Maybe I am misremembering, but I thought you orginally passed on Heartland, what changed your mind?