2024 Portfolio Update

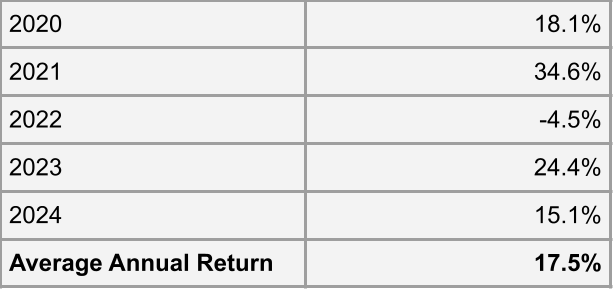

For 2024 my portfolio was up 15.1% and my five year average return was 17.5%

Performance Overview

My portfolio of individual stocks was up 3.8% in Q4, and produced a gain of 15.1% for the full year. The starting balance of the portfolio at the the beginning of the year amounted to $85,065 and ended the year at $146,028. Contributions to this portfolio for the full year amounted to $42,847.

The annual returns of my stock picking portfolio since I started publicly sharing my portfolio are shown below.

Year in Review

The end of 2024 is significant because it marks the 5th calendar year that I have publicly shared my portfolio holdings and returns (technically I didn’t start buying stocks in the current form of my portfolio until March 2020). When I set out to buy individual stocks I knew I would face a difficult road in trying to outperform the market. Despite this, I thought it was worthwhile to write about the journey, good or bad. Many people manage to outperform the market in any given year, but I think it takes at least a 5 year track record for an active investor to prove their worth. Since beating the market is difficult, my goal was to see how I did after five years, and if I underperformed then perhaps I should just buy index funds. This goal did have some weight to it because failure may have caused a slight existential crisis. On the other hand, I do enjoy researching stocks, so maybe I would still do this even if I slightly underperformed.

Going into this year I knew I was slightly ahead of the S&P 500, but I do not frequently compare myself to the index. As the year wound down, I was getting a bit nervous since my portfolio was doing pretty decent, but the S&P was pulled ahead in a dominate lead. To my surprise, I did manage to slightly beat the S&P over the five year period with my 17.5% return compared to the 16% return in the SPY index fund. At least the now the existential crisis is delayed for a bit.

Other interesting comparisons is the fact that small cap stocks and value stocks historically have outperformed the market. Yet these factors for the last ten years have failed to achieve their historical outperformance, getting stomped by the S&P 500. Adding some color, the VTV large cap value index did 9.9% over the last five years, while the IWM index that tracks the Russell 2000 only managed to do 7.3% during the period.

Without resting on my laurels, my new goal is to increase my margin of outperformance to further show that my value investing strategy is capable of superior returns. Hopefully my ever growing experience and the continued refining of my research and portfolio management skills pays off. Also, it would be a welcomed challenge to invest through a serious bear market to fully test my approach compared to a passive index.

Before getting into reviewing the events of 2024, I wanted to revisit a couple of topics that I discussed at the end of 2023. First, as you probably forgot by now there was a banking crisis back in 2023. The collapse of Silicon Valley Bank and a few others occurred in March of that year, and surprisingly this crisis did not spill over into other banks. Last year pundits were worried that deposits from regional banks would flee to the largest banks, causing distress in the regional banks. This has not panned out and the banks that I have owned (Capital One, Bank OZK, Hingham Institute for Savings) have seen their deposits remain about the same. For a while I have seen articles saying office defaults will doom the regional banks, but this has yet to play out.

Secondly, last year I discussed inflation and interest rates. The gist was that I felt like I held some stocks that could do fine during inflation, but would also benefit if interest rates came down. At the end of 2023, inflation seemed to be slowing and the pundits called for several interest rate cuts in 2024. Inflation did continue to moderate and the Federal Reserve cut rates twice this year. One of the main themes in the market this year was the decline in rates. The market likes easy money so surely this contributed to the gain in the S&P 500 this year. Then late in the year, the market had a tantrum when the Fed suggested they may not cut rates in 2025.

The decline in interest rates did not cause the basket of stocks I highlighted last year to revert back to fair value like I hoped, but several did have some nice gains this year. Stocks like British American Tobacco, Simon Property Group, and Verizon had high dividend yields but also have a lot of debt, which should have benefited from lower rates. I also thought my bank stocks would do well in a lower rate environment since deposit costs would decrease. It seemed like these companies were punished when rates are were high, so I figured they would see a nice rebound once there were rate cuts. Most of the stocks in this cohort had a nice run up in price, but then eventually gave back some of the gains. Towards the end of the year, Treasury yields started to creep back near 5%, bringing this thesis back to square one. That being said, Capital One and Simon Property Group had some strong price moves during the last quarter, and I ended up selling both of those positions. Inflation seems to have slowed down, but the 1970’s showed that you can not get too complacent.

The other main theme during 2024 was the rise of AI in particular, big tech stocks in general, and subsequently their impact on the performance of the S&P 500. Nvidia was the king of AI stocks since they are the primary producer of the types of chips needed for neural network training. Sales growth and AI hype drove Nvidia’s stock up 171% during the year and now their market capitalization is around 3.3 trillion dollars. The other big tech stocks like Microsoft, Alphabet, Amazon, Meta, Apple also showed nice gains since many of them operate cloud computing infrastructure that utilizes Nvidia’s chips to allow people to develop AI, or they are directly offering AI products to consumers. Obviously AI use cases will continue to grow in the coming years, but I find that people often overpay for hype. It is easy to attach unrealistic growth rates to these companies that eventually disappoint, or not foresee a changing competitive landscape. While I am a bit salty at gains of these tech stocks, I believe I can find good returns buying a handful of boring businesses at deep discounts to fair value.

Continuing with this theme, the big tech stocks made a large contribution to the gains in the S&P 500. Since the S&P 500 is market cap weighted, it holds more share of the largest companies. If these large companies move dramatically in price, it will have a large impact on the whole index. One way to illustrate this is to compare the 24.9% gain in the S&P 500 to the equal weighted version that was only up 12.8%. Another way to look at it is the top 10 stocks in the S&P 500 made up 33% of the index. This concentration was historically elevated during the Dot-com bubble and prior to the 2008 financial crisis. The current levels are actually higher than during the Dot-com bubble. Without getting too alarmed though, the big tech companies have been dominant businesses and consistently growing revenue for years so their size is a bit justified.

It has been tough for me because the big tech stocks have seemed expensive ever since I started investing in 2017. Part of my bearish sentiment is that growth stocks usually level off in growth, but the tech stocks have maintained growth to my surprise. I feel like every year my portfolio is fighting the big tech stocks although so far I have mostly held my own against them. It might have made my life easier to buy technology stocks in 2017, but it would not be quite as fun. However, I must say that I did miss the boat a couple of years ago when Meta sold off and briefly became a value stock.

Looking forward to 2025, there is a lot of big talk regarding tariffs, taxes, cutting government spending, deporting immigrants. All of these actions may or may not cause inflation, or growth, or a recession. I always try not to make macroeconomic predictions, but especially in 2025 I really do not have a clue what will happen. Luckily with my strategy I don’t pay much attention to macroeconomics, I will continue looking for buried treasure that is undervalued stocks.

Five Year Portfolio History

Here is a brief history of my holdings over the past 5 years. In 2017 I started setting aside some of my paychecks to buy individual stocks. My portfolio started with a few thousand dollars that I grew until 2019 when I cashed it out to buy a house. Going into 2020 I was rebuilding my savings and had a rollover 401k from a previous employer, plus some SPY put options. I occasionally buy SPY put options as a tail risk hedging strategy and these options were leftover from liquidating my portfolio. Holdings these options were fortuitous during March 2020, where I sold the puts for a large gain.

I deployed the proceeds to buy Emerson Electric, Capital One Financial, and Simon Property Group during the March lows. I thought these three companies were quality companies that would bounce back once the economy recovered. The riskiest bet was Simon Property Group since malls were closed, but they had plenty of liquidity to make their debt payments for a year, and if things were terrible for more than a year we were probably in Great Depression 2.0, at that point who cares.

Next I dabbled in the oil tanker trade. Since people stopped driving, there was an oversupply of oil that led to all storage facilities being full. The excess oil had to be stored in tanker ships parked on the coast. Tankers were charging high rates to do this so the tanker stocks looked cheap due to this windfall of cash. Unfortunately I was too much of a tanker tourist to foresee OPEC cutting production which caused the tanker stocks to decline. The tankers were a mediocre investment, but eventually I made a little money on them.

During the summer of 2020 I started buying some cheap microcaps like Friedman Industries, George Risk Industries, Paul Meuller Co, Richardson Electronics, and Surge Components. Several of these were trading below net current asset value. By March 2021, small stocks were having a massive rally so I started selling out of that batch of microcaps for over 50% gains. Throughout 2021 I bought a few statistically cheap stocks, trading at low EV/EBIT multiples such as Barrett Business Solutions, Gray Television, B2G Gold, Boise Cascade, M/I Homes. Then at the end of the year I bought Discovery and Qurate Retail. Both of these companies were cable TV networks trading at low multiples. Around the time of my purchase, Qurate was doing large buybacks and special dividends.

Major buys for 2022 included William Sonoma, Intel, and Omnicom. William Sonoma looked cheap despite continued growing sales and earnings. I think the market expected a decline in performance after the COVID stimulus high and was worried about a recession. Advertising giant Omnicom was also cheap mostly due to recession fears. Intel sold off heavily due to declining PC sales that were previously elevated as many people were working from home. Competition from AMD also intensified since Intel was having difficulty manufacturing the latest generation of transistors while AMD utilized Taiwan Semiconductor to manufacture their chips. I thought the market was overreacting to the situation and that Intel could catch back up with competitive chips. This was complemented by also buying more statistically cheap stocks.

One development that I was bullish on was the announcement that Discovery would merge with Warner Media that was spun out of AT&T. That meant Discovery became Warner Brothers Discovery (WBD). I thought the situation would be like the spin offs discussed on Joel Greenblatt’s book, where institutional investors sell off the shares they received during the spin. Once the institutional sellers stop selling, the spinoff will look cheap and eventually revert back to fair value. Unfortunately, that last part never happened with WBD.

Several of the key holdings that are currently in the portfolio were bought in 2023. Included in this bunch are Verizon, Alico, Hingham Institute for Savings, Bank OZK preferred stock, and Seneca Foods. Midway through the year I sold long time holding Emerson Electric due to the change in capital allocation strategy. At the end of 2023 I sold William Sonoma and Intel for nice profits, and got rid of WBD and Qurate that did not pan out as I hoped. Both Warner Brothers Discovery and Qurate had a large amount of debt, so poor business performance is magnified and heavily impacted the stock price. That brings us to 2024 where I sold two of my longest positions, Capital One and Simon Property Group. I bought Motorcar Parts of America, Tandy Leather Factory, Jewett-Cameron, and Net Lease Office Properties, Bank OZK common stock to get the about where it is today.

Investment Philosophy

Ever since I bought my first stock in 2017 I have employed a value strategy. However I have continually refined my process over that period of time. Initially I tried to balance cheap stocks with moats with buying statistically cheap. The cheap stocks with moats paid off pretty well with COF, SPG, EMR, etc. The statistically cheap stocks were hit or miss.

I ran into two problems with the quantitative value approach. First, you are supposed to buy a basket of about 20 stocks, however I would get choosy and only hold like 7 at a time. Second, after COVID many companies received a large boost in sales and profits due to stimulus. The inflated profits made many stocks look cheap on an EV/EBIT basis, but I felt it was an illusion once profits fell back to normal. Also I tended to do less due diligence on the statistically cheap stocks since you were supposed to buy a basket of them. There were a few instances were if I did some basic due diligence, I would have weeded out some losers. Now I use statistical methods to find cheap stocks, but perform a minimum amount of analysis before buying.

The whole reason why I think value investing works is that you are buying out of favor stocks that eventually the market forgets why they hate the stock. This means I need to know why the market does not like the stock, and try to make a judgement that the reason is temporary and not as big of a deal as the consensus belief. Examples causes of stocks going out of favor include missing earnings estimates, industry is in a down cycle, industry perceived as dying even if the particular company is doing well, or some sort of scandal.

The next thing is that I want to understand the business. How exactly does the company generate revenue, what business segments does it have, what geography do the sales come from, what are the major expenses. I’m not trying to know everything about the company, just a rough black box of how the business works. It seems like most analyst questions during earnings calls are for the most minute and pointless details. Learning about the business involves reading 10K/10Q, and listening earnings calls. This research supports the effort of the first point in trying to understand why the company is out of favor.

Finally I want to do a back of the envelope calculation of fair value. This does not need to be a complex spreadsheet analyzing every expense and trying to accurately predict revenue. The undervalued stock should look obviously cheap based on some basic inputs. It's about trying to roughly estimate these inputs and track the key variables to see if the company is moving in the right direction. Over the past year I have gotten more disciplined at applying this approach so hopefully the results will bear fruit this coming year.

Portfolio Composition

The current allocation of the portfolio is shown in the chart below. Currently, the portfolio consists of 13 stocks. The top five largest positions are British American Tobacco, Jewett-Cameron, Net Lease Office Properties, Hurco Companies, Tandy Leather Factory.

Portfolio Update

There were a handful of stocks that produced meaningful gains throughout 2024. Some of the biggest gains this year were from British American Tobacco (BTI), Motorcar Parts of America (MPAA), Capital One Financial (COF), Hingham Institute for Savings (HIFS), Simon Property Group (SPG), and Seneca Foods (SENEA). British American Tobacco has been one of my largest holdings, and was underwater for quite some time. The stock rallied this year, my position seeing a 25% gain since the beginning of the year. MPAA was a company that I bought midway through the year and it bounced around to eventually produce a 50% unrealized gain. Hingham also had a nice run, my position increasing by 31%.

During 2024, I ended up selling a few stocks for nice gains. I sold Capital One for a 190.7% gain, Simon Property Group was 134.8%, and Seneca Foods provided a gain of 81%. Keep in mind that these are the total realized gains, I have owned COF and SPG for over 4 years, but owned SENEA for about 6 months. Both COF and SPG did have a nice run up before I sold them so they did contribute to the portfolio returns.

I had several stocks that provided realized and unrealized losses, but only two had a meaningful contribution. My Alico position was down about 8.1% for the year, which was mildly painful since it was such a large holding. However the biggest loser by far was Spirit Airlines. I sold Spirit once the Department of Justice won their suit blocking the merger with JetBlue. Shares tumbled and I got out with a 40.6% loss.

British American Tobacco continued to be one of my largest holdings throughout 2024, with me adding some more shares in the spring. The company’s financial performance has been mediocre, but the cigarette volume decline in the US has weighed down results. Other headwinds are illegal imported vapor products taking significant market share from BTI and other tobacco companies legitimate products. Some states have passed laws to register tobacco products and the industry is lobbying the FDA to enforce the law to get these illegal products off the street. Despite the continued malaise, all the tobacco stocks had a nice rally last fall. Now that my BTI position is finally showing a small gain, that 8% dividend yield feels sweeter.

Jewett-Cameron is a tiny company with a $17M market cap that is neck and neck with BTI as my largest holding. The company sells a variety of products such as wood panels for busses, dog kennels, and a proprietary fence latch kit. JCTC also had a seed processing plant that they closed last year. Jewett-Cameron’s operating performance has not been great lately, but should improve as consumer confidence and home sales increase. I was interested in the stock since it was trading below its net current asset level. But really got me excited was that Jewett-Cameron listed the 11 acre former seed plant site for sale, which is located on the edge of a small town in Oregon. My rough estimation is that this land could sell for around $5M, a good chunk of the company’s current market capitalization. Hopefully when the land sells, the stock reverts closer to fair value and JCTC can use the proceeds to buyback stock or pay a nice dividend.

Another real estate play is Net Lease Office Properties, which is a office REIT that was spun off from a larger REIT in 2023. NLOP holds a portfolio of office properties that it is slowly selling. The company has some debt, so the plan is to pay off the debt with sale proceeds. Once the debt is paid off, then the proceeds will be paid out to shareholders. NLOP has managed to sell $364M worth of property in 2024 and has nearly paid off their debt. Offices are a hated industry right now but I think the market is overly punishing NLOP stock. By my calculations, the stock is trading at a large discount to a conservative estimate of the value of the buildings. I think once the company starts making distributions to shareholders, the market will finally notice how cheap this stock is.

Alico is the largest orange grower in Florida. I have owned the stock for a couple of years now and the price movement has been lackluster. I bought the stock after earnings suffered due to bad harvests from Hurricane Ian that hit back in 2022. However it took longer than expected for the trees to recover from the hurricane. Plus the orange groves have been fighting a disease called citrus greening. This scenario has caused Alico’s financials to suffer longer than I anticipated. However I did not buy Alico primarily for its citrus operations, I was more interested in its land. Alico at one point had around 70k acres of ranch land and about 50k acres of citrus land. When I bought the stock, they were already in the process of selling off all the ranch land, which they finished selling in late 2023. While selling off the ranch land, the company paid off debt, did some buybacks, and paid a special dividend, some of this was before my time as a shareholder.

Despite the ranch land being gone, the citrus land is carried on the books at an undervalued price. Valuing the orange grove land based on recent transactions suggests that the stock is trading at a large discount to the true value of the land. Plus some of the land is in desirable development locations that can fetch a much higher price than regular agricultural land. My thought was that once Alico’s trees recovered and there was a couple of good harvests, the stock would move closer to historical multiples of book value. This plan is now obsolete because the company recently announced that they are giving up on growing oranges. Alico is now going to focus on the best use of their land. That entails using the land for more profitable agriculture, and beginning the process of liquidating the land holdings. Now I just have to sit patiently as Alico slowly cashes in on their highly undervalued land.

Keeping up with this theme of stocks with undervalued real estate, another key holding is Tandy Leather Factory. Tandy operates retail stores that sell leather crafting materials. TLF is another tiny company, with a market capitalization of $38M. The operating performance has suffered last year, but the stock is trading below its net current asset value. As if being a net-net is not a good enough reason to own Tandy, a couple of activist funds own a large chunk of the company. They pushed for Tandy to sell their headquarters/main distribution center that is located in the Dallas area. I looked at a few comparable properties and thought their headquarters could fetch $15M. It was recently announced that the property is under contract for $25M, which is about ⅔ of the company’s market cap. I think investors will wake up to this company once the cash hits the financial statements. Again I am hopeful that a good chunk of these proceeds will be returned to shareholders through a buyback or dividend.

Stocks Purchased in Q4

Stocks Sold in Q4

Dividends Received in Q4

Stocks Mentioned: BTI 0.00%↑ ALCO 0.00%↑ HURC 0.00%↑ TLF 0.00%↑ JCTC 0.00%↑ OZKAP 0.00%↑ OZK 0.00%↑ HIFS 0.00%↑ SENEA 0.00%↑ COF 0.00%↑ SPG 0.00%↑ EMR 0.00%↑ VZ 0.00%↑ NLOP 0.00%↑ MPAA 0.00%↑ DG 0.00%↑